Irs tax estimator 2021

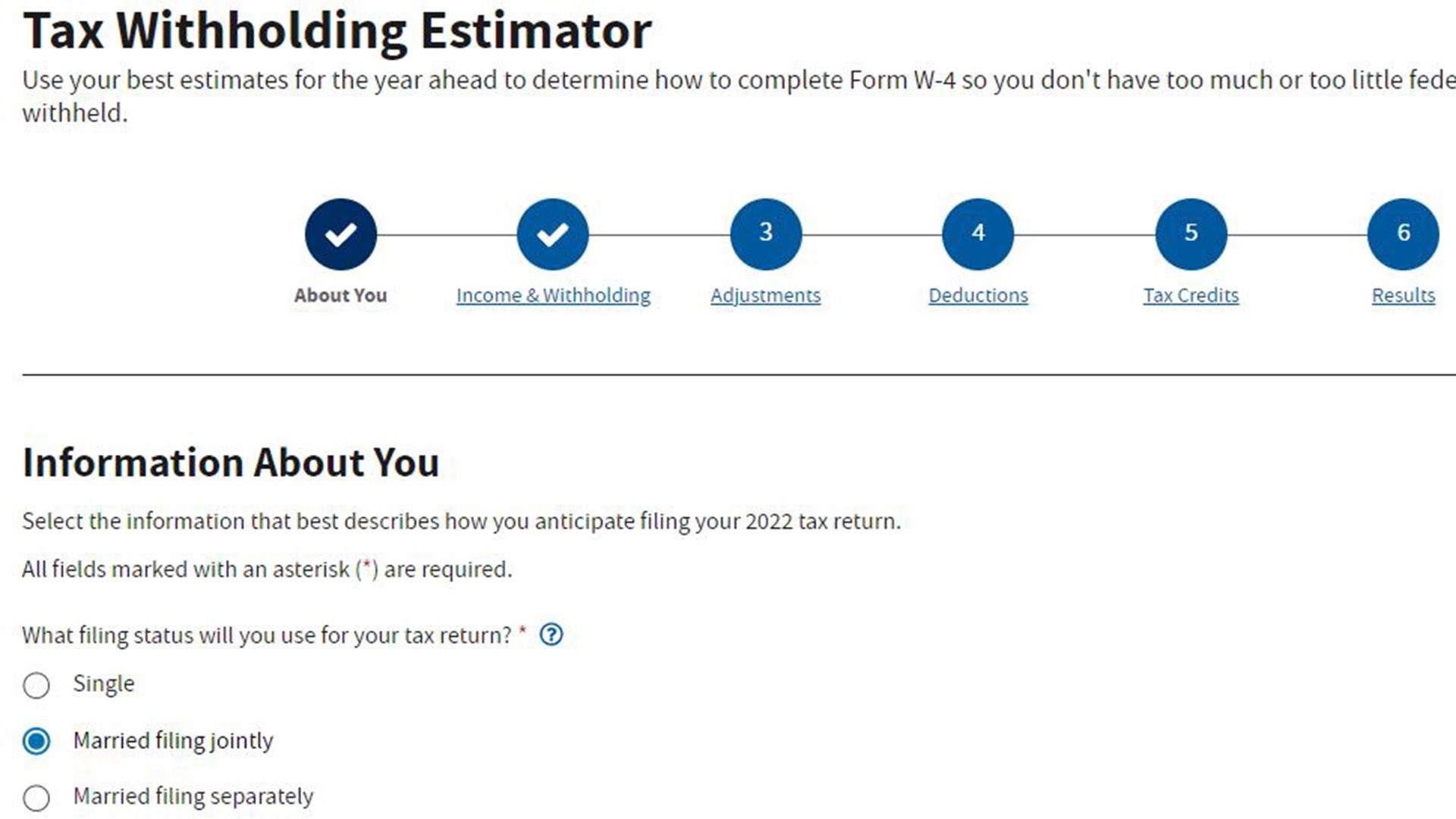

All taxpayers should use the IRS Tax Withholding Estimator to check their withholding. Determine if they should complete a new Form W-4.

Make Your Form2290filing Easy And Secure With The Help Of The Provided Irsform2290taxfiling The Free Gross Weight Of Your Vehicle Wi Irs Forms Irs Taxes Etax

Your Tax Refund Date in 2022 for your 2021 Tax Return Refund.

. Terms and conditions may vary and are subject to change without notice. Tax Withholding Estimator benefits. Use any of these 10 easy to use Tax Preparation Tools.

By using this site you agree to the use of cookies. Best online tax calculator. In the last year did you get married.

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

Enter your filing status income deductions and credits and we will estimate your total taxes. In most cases you must pay estimated tax for 2021 if both of the following apply. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Calendar year farmers and fishermen. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. This tool helps people make sure their employers are taking out the right amount of tax from the employees paychecks.

With dependents age 17 or older. Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return results. Ad Estimate Your Tax Refund w Our Tax Calculator.

The 2022 tax values can be used for 1040-ES estimation planning ahead or. IRS. This online tool offers workers self-employed individuals and retirees who have wage income a.

Use our calculator to estimate your 2021 taxable income for taxes filed in 2022. Neither HR Block. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

IRS Tax Tip 2021-98 July 8 2021. IR-2022-81 April 13 2022. It is mainly intended for residents of the US.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. When youre ready to file your taxes sign in to your account update the areas that need corrections and e-file your tax return with the IRS. Fill in the step-by-step questions and your tax return is calculated.

For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021 Estimated Taxes. Effective tax rate 172. You expect your withholding and refundable credits to be less than the smaller of.

Estimate your tax refund with HR Blocks free income tax calculator. Knowing which tax bracket you are in can help you make better financial decisions. 2021 HRB Tax Group Inc.

Who itemized deductions on prior year returns. Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Weve Got You Covered. Use this Calculator for Tax Year 2021. HR Block Maine License Number.

Plan Ahead For This Years Tax Return. Only certain taxpayers are eligible. Estimate your 2021 Return first before you e-File by April 18 2022.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay.

Estimate Your Taxes For Free And Get Ahead On Filing Your Tax Returns Today. 1040 Tax Estimation Calculator for 2022 Taxes. Who claim credits such as the child tax credit.

It can be used by workers as well as retirees self-employed individuals and other taxpayers. With other personal and financial changes. Know what information to put on a.

Use any of these 10 easy to use Tax Preparation Calculator Tools. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. We provide NO GUARANTEE about the accuracy or.

This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. Find out the estimated Tax Refund Date of your. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

These Tax Calculators will give you answers. Then get your Refund Anticipation date or Tax Refund Money in the Bank Date. This site uses cookies.

See terms and conditions for details. You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable credits. If youre a calendar year taxpayer and at least two-thirds of your gross income for 2021 or 2022 is from farming or fishing you have only one payment due date for your 2022 estimated tax January 17 2023.

Know your estimated Federal Tax Refund or if you owe the IRS Taxes. 90 of the tax to be shown on your 2021 tax return or. Partner with Aprio to claim valuable RD tax credits with confidence.

WASHINGTON The Internal Revenue Service today urged any taxpayer now finishing up their 2021 tax return to use the IRS Tax Withholding Estimator to make sure theyre having the right amount of tax taken out of their pay during 2022. 2021 Tax Return Estimator Calculator. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. And is based on the tax brackets of 2021 and 2022. The IRS Tax Withholding Estimator can help taxpayers.

Estimate your 2021 taxes.

Infographics Will I Owe The Irs Tax On My Stimulus Payment

New 2021 Irs Income Tax Brackets And Phaseouts

Irs Tax Brackets Here S How Much You Ll Pay In 2021 On What You Earned In 2020

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Irs Taxes Tax Table Tax Brackets

Irsnews On Twitter Check Your Tax Withholding Today To Determine If You Need To Make Adjustments And Avoid An Unexpected Tax Bill When You File Next Year The Irs Tax Withholding Estimator

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How To Keep Your 2022 Irs Tax Refund Money Now Rather Than Wait King5 Com

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

2021 Form 1040 Tax Table 1040tt

2021 Irs Tax Bracket Internal Revenue Code Simplified

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca