Tax off paycheck calculator

Estimate your federal income tax withholding. See how your refund take-home pay or tax due are affected by withholding amount.

Paycheck Manager Free Payroll Calculator Demo Step 2

First enter the net paycheck you require.

. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Get an accurate picture of the employees gross pay.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Use this tool to.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This calculator helps you determine the gross paycheck needed to provide a required net amount.

The results that the calculator give you are calculated with consideration to the most recent income tax and social security information available for the tax year 202223. That means that your net pay will be 43041 per year or 3587 per month. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Some states follow the federal tax. Then enter your current payroll information and. Your employer will withhold money from each of.

The IRS made notable updates to the. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Small Business Low-Priced Payroll Service.

Your average tax rate is. Free salary hourly and more paycheck calculators. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

For example if an employee earns 1500. How do I calculate hourly rate. That means that your net pay will be 37957 per year or 3163 per month.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. The state tax year is also 12 months but it differs from state to state. How to calculate annual income.

Next divide this number from the. 3 Months Free Trial. It can also be used to help fill steps 3 and 4 of a W-4 form.

Need help calculating paychecks. The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

Your average tax rate is. Starting as Low as 6Month. Hourly Paycheck and Payroll Calculator.

How To Calculate Taxes On Paycheck Clearance 54 Off Www Ingeniovirtual Com

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

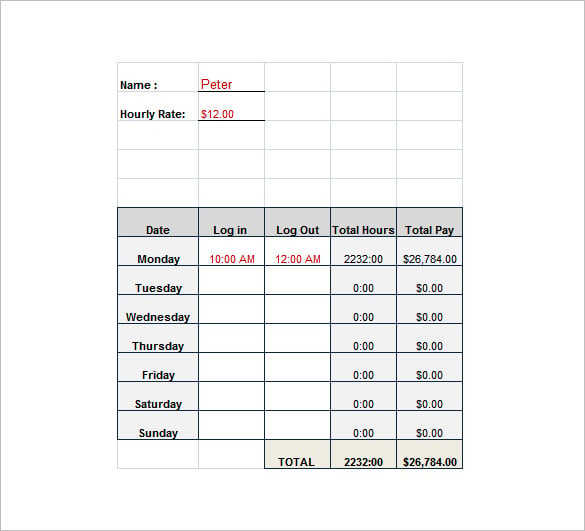

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Wage Calculator With Tax Store 56 Off Www Ingeniovirtual Com

Wage Calculator With Tax Top Sellers 52 Off Www Ingeniovirtual Com

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Wage Calculator With Tax Top Sellers 52 Off Www Ingeniovirtual Com

Wage Calculator With Tax Top Sellers 52 Off Www Ingeniovirtual Com

Wage Calculator With Tax Store 56 Off Www Ingeniovirtual Com

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free Online Paycheck Calculator Calculate Take Home Pay 2022