51+ what percentage of my income should go to mortgage

Veterans Use This Powerful VA Loan Benefit For Your Next Home. See how much house you can afford.

How Much House Can You Afford Readynest

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

. Compare More Than Just Rates. Web Going by the 28 percent rule the borrower should be able to reasonably afford a 1400 mortgage payment. This rule says you.

Web The Bottom Line. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. The 3545 Rule The 3545.

Web The 28 Rule. Ad Only Takes Minutes to Check 0 Down No PMI and Interest Rates with a Loan Specialist. Web Total monthly debt repayment 3485.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. However many lenders let borrowers exceed 30.

Keep your total monthly debts including your mortgage. Get 0 Down No PMI and More. Keep your mortgage payment at 28 of your gross monthly income or lower.

This rule says that you should not. Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Web The name for this rule comes from two measures of how your debt compares to your incomeyour front-end and back-end debt-to-income ratio DTI.

Web 28 of Gross Income. The 28 rule isnt universal. No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward housing.

Total monthly household income before tax 10000. Debt to income ratio 3485 divided by 10000 03485 3485 or 35 just. Compare More Than Just Rates.

And you should make. However factoring in the 36 percent rule the. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web The 3545 Model.

Principal interest taxes and insurance. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad Calculate Your Payment with 0 Down.

Take Advantage of Your Hard-Earned VA Mortgage Benefits. Thats a mortgage between 120000 and. Get 0 Down No PMI and More.

Some financial experts recommend other percentage models like the 3545 model. One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Ad Only Takes Minutes to Check 0 Down No PMI and Interest Rates with a Loan Specialist.

Take Advantage of Your Hard-Earned VA Mortgage Benefits. Web The 2836 rule is a good benchmark. But some borrowers should set their personal.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility. Find A Lender That Offers Great Service.

Find A Lender That Offers Great Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income.

Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. Even with this 43 threshold lenders generally require a more. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

What Percentage Of Income Should Go To Mortgage

The Electric Car Has Never Been Greener Bloomberg

What Percentage Of Your Income Should Go To Mortgage Chase

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

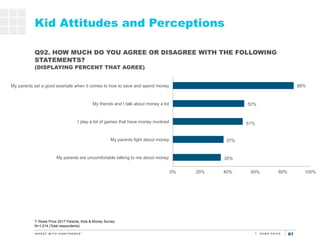

T Rowe Price Parents Kids Money Survey

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

51 Se Sedona Cir Apt 204 Stuart Fl 34994 Realtor Com

Budget Percentages What Percentage Of Your Income Should Go To

Housing Expense Guideline For Financial Independence

How Much Of My Income Should Go Towards A Mortgage Payment

2245 Sw Trailside Path Stuart Fl 34997 Zillow

51 Se Harbor Point Dr Stuart Fl 34996 Realtor Com

51 Se Sedona Cir Apt 102 Stuart Fl 34994 Realtor Com

What Percentage Of Income Should Go To Mortgage

51 Se Sedona Cir Apt 204 Stuart Fl 34994 Realtor Com

What Percentage Of Annual Income Should Go To Rent